nj 529 contributions tax deductible

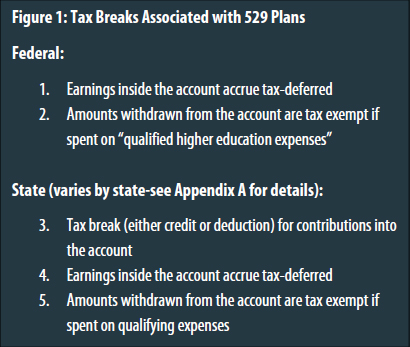

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level.

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

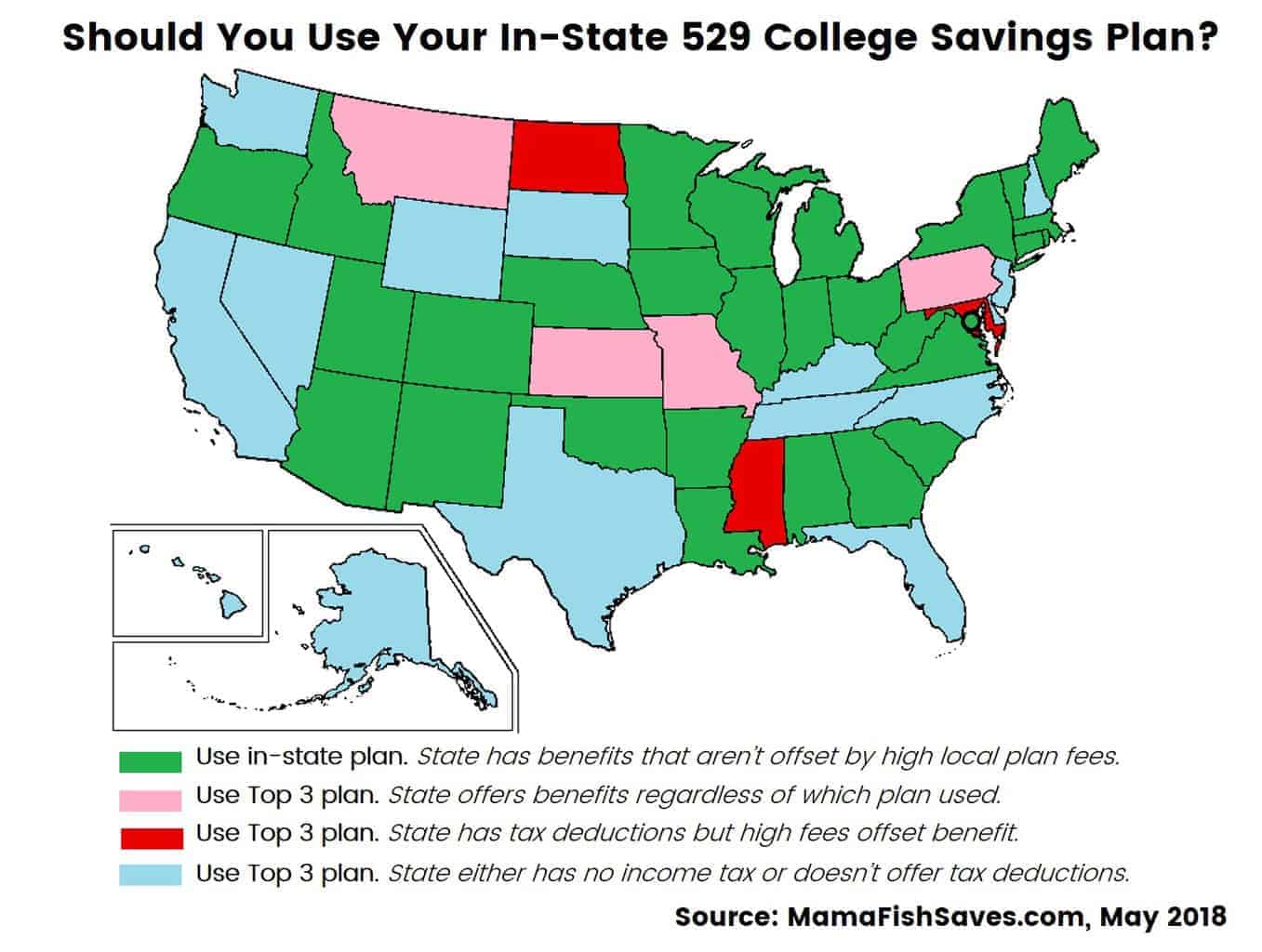

Visit individual plan websites for current information about fund expenses minimum.

. More information is available on the. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. However tax savings is not the only thing to focus on.

A 529 plan is designed to help save for college. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Married grandparents in Nebraska.

Section 529 - Qualified Tuition Plans. The New Jersey tax savings is approximately 500. 20 tax credit on.

Up to 10000 per year may be withdrawn from 529 savings plans federal income tax-free if used for tuition expenses at private public and religious K-12. Contributions are not tax deductible. Thanks to recent legislation however you may now be able to deduct up to.

Beginning with Tax Year 2022 filed in 2023 the New Jersey College Affordability Act allows for three Income Tax deductions on New. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct up to. 07 MarNJ tax treatment of 529 Plan earnings.

Contributions to such plans are not deductible but the money grows tax-free while it. However some states may consider 529 contributions tax deductible. The plan NJBEST is offered through Franklin Templeton.

Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Never are 529 contributions tax deductible on the federal level. As of January 2019 there are no tax deduction benefits when making a contribution to a 529.

Check cashing not available in NJ NY RI VT and. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for. A 529 plan is designed to help save for college.

Management fees annual fees and performance are other important. New Jersey No Yes Beginning with the 2022 tax year maximum deduction of. New Jersey College Affordability Act.

NJBEST 529 College Savings Plan. Also under the New Jersey College Affordability Act if you earn 75000 or less a year you may be eligible for up to 750 given as a matching grant for amounts you have. State-by-state outline of the various state section 529 plan deductions.

New Jerseys plan doesnt offer much.

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

An Alternative To 529 Plan Superfunding

529 College Savings Plan Options Broken Down By State

How Much Are 529 Plans Tax Benefits Worth Morningstar

New Jersey Provides Tax Deduction For College Savings Plan Contributions

529 Plans Which States Reward College Savers Adviser Investments

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

New Jersey Provides Tax Deduction For College Savings Plan Contributions

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Tax Benefits By State Invesco Invesco Us

9 Benefits Of A 529 Plan District Capital

Does Your State Offer A 529 Plan Contribution Tax Deduction

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

Will N J Ever Allow Deductions For 529 Plan Contributions Nj Com

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen